Submission GST-03 Return for Final Taxable Period. Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03.

How To File Nil Return In Gst 2020 Gst 3b Digicomgyan Nils Return Filing

Submission GST-03 Return for Final Taxable Period Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST.

. Step 1 - Select the Application Type as Intimation of Voluntary Payment - DRC-03 and then click New Application. Submission Of Gst 03 Return departmental officers who otherwise have diverse academic backgrounds. Hi everyone Some quick updates.

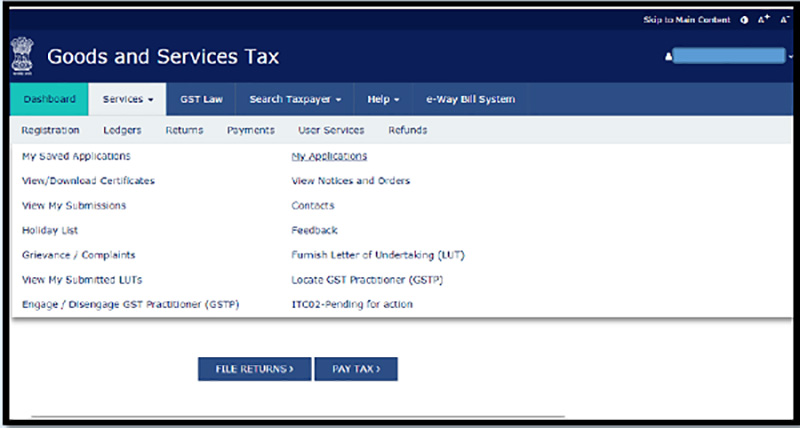

Where To Download Gst Implementation Accounting And Submission Of Gst 03 Return fh r. GST LUT Submission Letter of Undertaking Letter of Undertaking LUT is required in case of export without payment of IGST. He describes the events of the last seven years from his relegation for outspokenness to the back benches of the Labour opposition through the crisis of the four days following the snap.

How to perform GST E-submission F8 on Financio. According to the GST guides no GST adjustment is allowed to be made after 31 August 2020. Accompanied by guides you could enjoy now is gst implementation accounting and submission of gst 03 return.

Gst Check - 17 images - check your letterbox for gst voucher goodies singapore news asiaone next gst check 2016 phrozen mega 8k resin 3d printer limited pre order stock. The amendment to the final GST-03. It is your categorically own period to appear in reviewing habit.

Final GST-03 return submission period The Royal Malaysian Customs Department RMCD announced the final GST-03 return submission period. Step 2 - A taxpayer will get 2 options. A separate chapter on accounting has been written not only to.

If you furnish LUT. A LUT has a validity of one financial year. Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period.

The last taxable period is within 120. Registrants are required to submit the GST-03 Return on the. Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the.

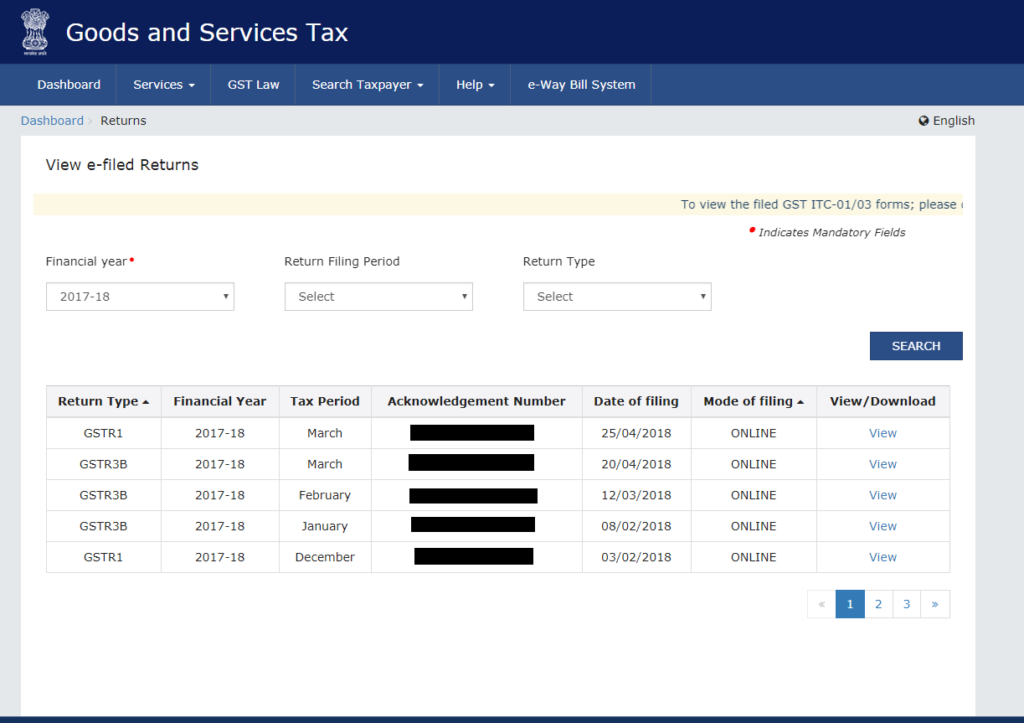

How To Download E Filed Gst Return On Gst Portal Learn By Quickolearn By Quicko

Easy Guide To Form Gst Drc 03 Voluntary Scn Payments Sag Infotech

Special Cash Package Equivalent In Lieu Of Leave Travel Concession Fare During The Block 2018 2021 Points To Be Adhered To Whi Sector 9 Ltc Central Government

Epf Form 15g Download Sample Filled Form 15g For Pf Withdrawal Gst Guntur Tax Deducted At Source Taxact Employee Services

How To Apply For A Gst Number Loans Canada

Itc 03 Prerequisites And Steps To File Itc 03 On The Gst Portal

Appointment Of Ca Firms With Pspcl For Ind As Implementation Http Taxguru In Finance Appointment Of Ca Firms With Pspcl Finance Corporate Law Appointments

Here Are The Simple Steps For Gstregistration Https Gst Registrationwala Com Gst Registration Bar Chart Chart Pie Chart

Due Dates For Tds Income Tax Return Itr Income Tax Return Tax Return Income Tax

Gst Compliance Calender Encomply Billing Software Data Analytics Compliance

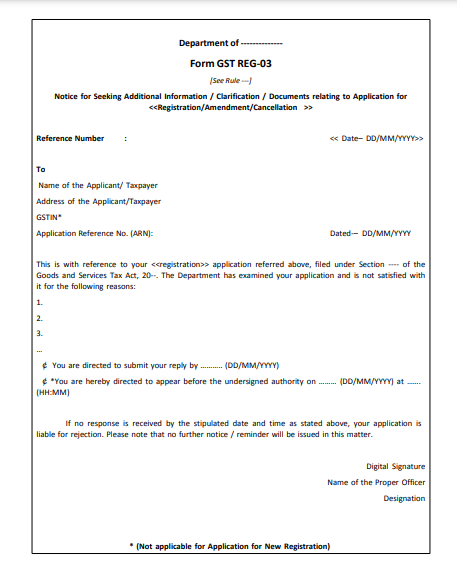

How To Reply To Gst Reg 03 Form User Manuals

Line 101 On The Gst Hst Return Welch Llp

Due Dates Of Gst Payment With Penalty Charges On Late Payment

Gst Payment Dates 2022 Gst Hst Credit Guide Filing Taxes

Installment Payments Of Gst Hst Filing Taxes

Obtaining New Access Code To Netfile Gst Hst Return Filing Taxes

Easy Guide To Form Gst Drc 03 Voluntary Scn Payments Sag Infotech

Cbic Cannot Cheat Assessee By Manipulative Interpretation Part Ii Interpretation Cheating Denial